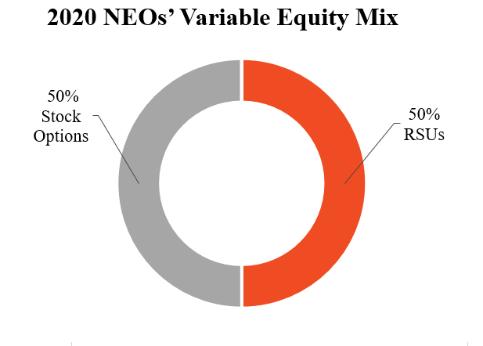

| | timing of future business recovery, the compensation committee decided to award a mix of 50% time-based restricted stock units (“RSUs”) and 50% stock options and to forgo performance-based restricted stock units (“PBSs”) for 2020. The compensation committee believes that the performance orientation of options strongly aligns the executive with stockholders, especially in the time of economic recovery. |

OverviewOur Company

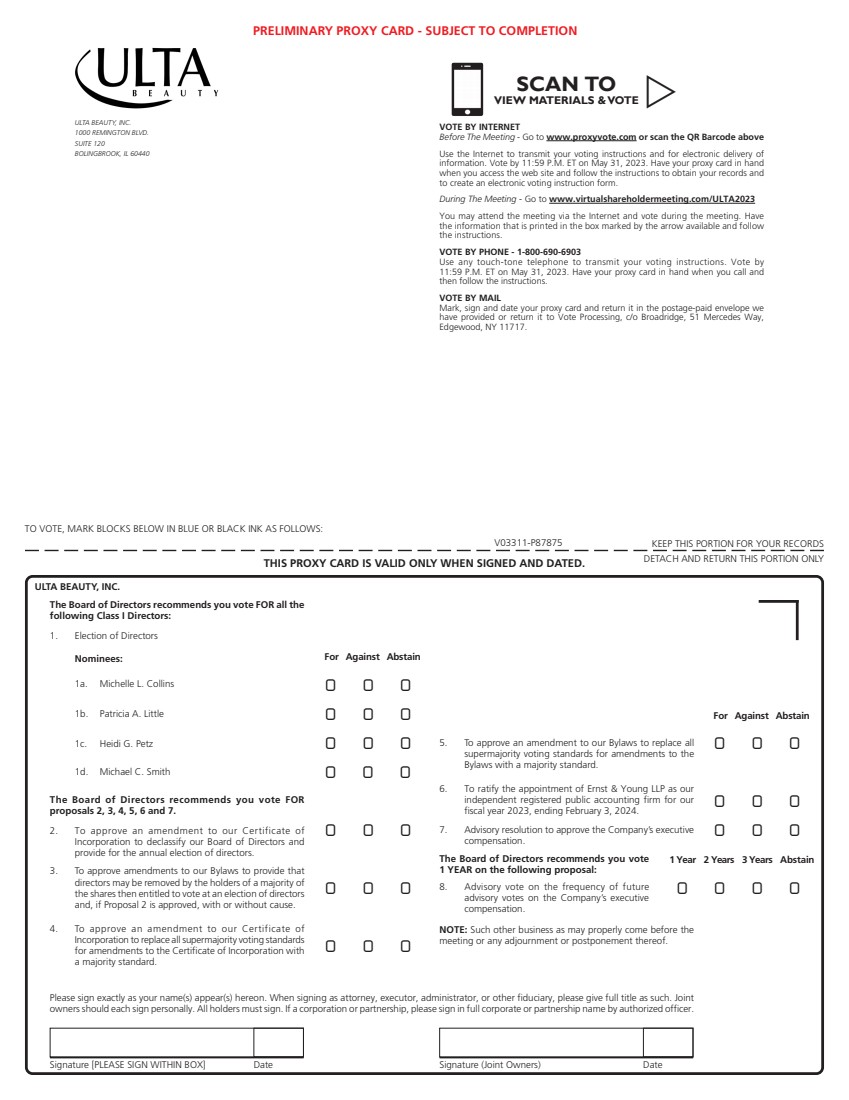

This Compensation Discussion and Analysis describes the Company’s executive compensation program and explains how the compensation committee made compensation decisions for the following Named Executive Officers’ (“the NEOs”) related to fiscal 2020:

|

|

|

|

Named Executive Officer

|

|

| Title

|

Mary N. Dillon

|

|

| Chief Executive Officer

|

David C. Kimbell

|

|

| President

|

Scott M. Settersten

|

|

| Chief Financial Officer, Treasurer and Assistant Secretary

|

Jodi J. Caro

|

|

| General Counsel, Chief Compliance Officer and Corporate Secretary

|

Jeffrey J. Childs

|

|

| Chief Human Resources Officer

|

Our Company

Ulta Beauty is the largest beauty retailer in the United States and the premier beauty destination for cosmetics, fragrance, skin care products, hair care products, and salon services. We provide unmatched product breadth, value, and convenience in a distinctive specialty retail environment. Key aspects of our business include:

Shopping Experience.One-of-a-kind Assortment. OurWe offer guests can satisfy alla differentiated assortment of their beauty needs at Ulta Beauty. Our stores, website, and mobile applications offer more than 25,000 products from more than 600 well-established and emerging beauty brands across a variety of categories and price points, including Ulta Beauty’s own private label, the Ulta Beauty Collection. Our bright and open store environment and easy to shop website and mobile applications encourage our guests to discover new products and services.points. We believe we offer the widest selection of beauty categories, including prestige and mass cosmetics, fragrance, haircare, prestige and mass skincare, bath and body products, professional hair products, and salon styling tools. We also offer a full-service salon in every store featuring hair, skin, makeup, and brow services.

Value Proposition.Store Footprint. We believe our focus on delivering a compelling value proposition to our guests across all of our product categories drives guest loyalty. We offer a comprehensive loyalty program, Ultamate Rewards, and target communications and promotions through our Customer Relationship Management platform. We also offer frequent promotions and coupons, in-store events, and gifts with purchase.

Convenience. Today, we offer guests a variety of ways to shop for beauty, including in ouroperate more than 1,350 stores through our mobile applications, and on ulta.com. We also provide convenient fulfillment options including buy online pick-up in store, buy online pickup curbside, ship from store, and ship to home. Our stores are predominantly located in convenient, high-traffic locations such as power strip centers. Our typicallocations. With a bright and open store is approximately 10,000 square feet, including approximately 950 square feet dedicatedenvironment, we make it easy for guests to our full-service salon.discover new products and services. Our store design, fixtures, and open layout provide the flexibility to respond to consumer trends and changes in our merchandising strategy. AsWe also offer a full-service salon in nearly every store featuring hair, eyebrow, and other beauty services. In addition to our free-standing locations, through our partnership with Target Corporation, we have more than 350 Ulta Beauty at Target shop-in-shops which provide guests with a highly-curated, prestige beauty assortment in a unique and elevated presentation in 1,000 square feet of January 30, 2021,dedicated space within certain Target locations.

Leading Digital Experiences. Through our website, Ulta.com, and our mobile applications, we operated 1,264 retail storesoffer guests convenient, interactive, and personalized digital experiences. Our digital channels enable always-on shopping and discovery, and our diverse fulfillment options, including buy online pick-up in store, buy online pick-up curbside, ship from store, ship to home, and same-day delivery, provide guests with value and convenience. In addition to e-commerce platforms, we offer guests a variety of unique digital experiences, including virtual try-on and skin analysis tools, which leverage augmented reality capabilities and artificial intelligence tools to provide guests with personalized experiences.

Best-in-Class Loyalty Program.Our best-in-class loyalty program, Ultamate Rewards, enables members to earn points for every dollar spent on products and beauty services at Ulta Beauty, through purchases on our private label and co-branded credit cards, and purchases at Ulta Beauty at Target. In addition to unique membership benefits, members can redeem points for discounts on any product or service at Ulta Beauty. With more than 95% of total sales coming from members, we are uniquely positioned with a deep understanding of our customers and their preferences, enabling us to personalize experiences, recommendations, and promotions through our Customer Relationship Management (CRM) platform and support our brand partners’ growth.

Great Guest Experiences.We cultivate human connection with warm and welcoming guest experiences across 50 states, as well as an e-commerce websiteall of our channels. Our knowledgeable and mobile applications.approachable store associates, our differentiated service offerings, and our efforts to create relevant, compelling digital content are competitive advantages and enable us to build strong engagement with guests.

We were founded in 1990 as a beauty retailer at a time when prestige, mass, and salon products were sold through distinct channels — department stores for prestige products; drug stores and mass merchandisers for mass products; and salons and authorized retail outlets for professional hair care products. We developed a unique specialty retail concept that offers a broad range of brands and price points, a compelling value proposition,select beauty services, and a convenient and welcoming shopping environment. We define our target consumer as a beauty enthusiast, a consumer who is passionate about the beauty category, uses beauty for self-expression, experimentation, and self-investment, and

1

1

1

1